Repeat loan with profit! Use promo code S109 and get a -35% discount on your next loan. Apply now and save money with us!

Lack of funds to cover mandatory expenses is a common problem. It can be challenging to find the required amount of money. Lenders require proof of creditworthiness, claim the presence of a loan (guarantor), and dictate other confusing conditions.

Any user can ease the situation and quickly close the hole in finances today. For this, Loan Plus lk offers to apply for a loan online. You can find out what documents are needed and how to fill out the application form from a company representative or this article. Let's get started!

What you need to do before you apply for a loan from Loanplus

Taking out a loan from Loanplus can help you in a financial emergency. But before you take out a loan, remember this:

- Look for feedback, read through pages of the enterprise on social media.

- You must understand all terms and conditions before signing the agreement.

- Confirm that all repayment terms can be met before taking up a loan.

- Ensure that you pay back the whole amount borrowed not later than the due date since any delay may lead additional charges in form of extra fees or higher interest rates.

- You should have a clear understanding of how to refund the whole sum of money borrowed.

- Whether there is an opportunity to repay your debt early if it is needed for you.

These points should enable you settle financial emergencies safely.

How to apply for a loan online?

Users who are facing financial problems will quickly get credit funds. For this purpose, the company suggests using the official website where the required information is posted. Explore the deal details to get a response from the Loan Plus manager within 10 minutes.

Approving an application requires the fulfillment of several mandatory conditions. However, an impeccable credit history is not included in the list of requirements. It's easy to apply and receive funds to your Loanplus account on the website or app.

|

Place of residence |

Sri Lanka |

|

Employment |

Not required |

|

Age |

From 20 to 60 years |

|

First loan amount |

Up to 40 thousand rupees |

|

Maximum loan amount |

80 thousand rupees |

|

Guarantor / collateral |

Not required |

|

Application processing time |

10 minutes any day |

You can open the client form on the Loanplus page. Accessing the site from any device, including tablets and smartphones, is possible. The answer on the application will be sent to the mail or phone number specified in the registration form.

What information do customers provide?

It is possible to submit a request for accrual of credit funds online. It is convenient because you will not have to look for a Loan Plus branch in your city. To create a request, you need to specify:

- the borrower's first and last name;

- date of birth;

- bank account number;

- loan amount;

- preferred loan term.

Following the Loan Plus system prompts, you can instantly send your application for processing. Don't forget to enter your phone number and email address to receive notification of the decision. This way, you can get the funds on your card within 20 minutes, including processing your request.

What are the terms and conditions of the loan?

Customers who applied to Loanplus lk for the first time will not encounter difficulties. The company's official page contains detailed information about the conditions and terms of lending. A brief review will help ensure that personal preferences correspond to those on the website.

|

Minimum loan amount |

8 000 rupees |

|

Maximum loan amount |

80 thousand rupees |

|

Interest rate for new customers |

0.01% per day |

|

Interest rate at repeated application |

0.04% per day |

|

Loan term |

5-30 days |

Customers with a monthly income of 15 thousand rupees or more will be eligible for the loan. Enter this information in the form. Once the processing and approval are completed, the funds are credited to the specified Loan Plus details. For this reason, you need to ensure the details are correct.

How to get a loan from the company?

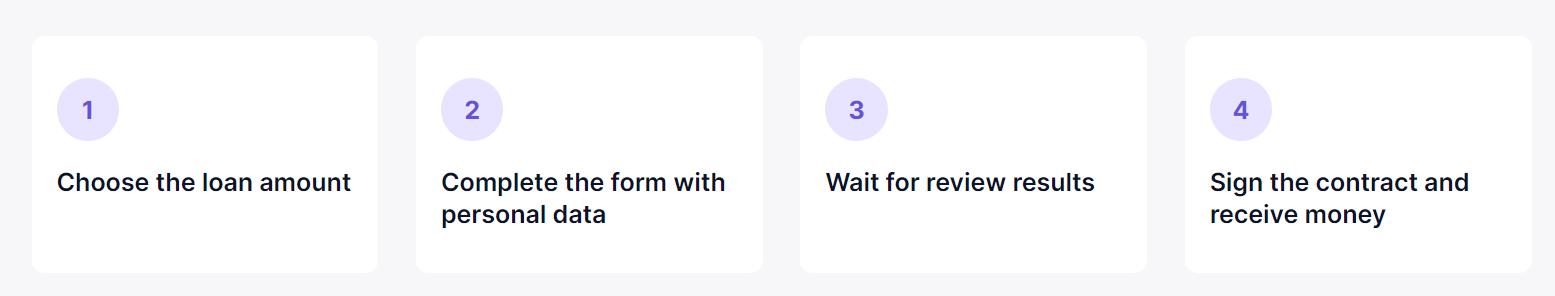

The application procedure is quite simple. You can find answers to common questions in a special website section. It contains popular customer queries that arise most often. Customers will learn from the posted answers how each stage of the loan application process goes, including:

- Loan requirements. Loan Plus Sri Lanka invites customers to specify the loan amount and find out the loan terms and conditions. So, the user gets information about the available terms, interest rates, and other data.

- Online form. You can fill out the application form quickly. Prepare an ID card to indicate the requested information. Next, you need to enter your phone number and email address.

- Loan Plus app response. Send the completed form to the manager and get a response within 10 minutes. During this time, the staff will verify the compliance and respond to the application.

- Contract. It will be possible to conclude the deal with the use of the electronic signature quickly. Read the agreement, paying attention to the credit terms. If you are satisfied with the data, sign the agreement.

- Accrual of funds. Funds are transferred immediately after signing the agreement. You can check the availability of money on the bank account whose data were specified in the application.

The credit period begins immediately after transferring the credit money to the card. The recipient has 30 days to repay the funds or extend the term. In the latter case, the amount to be paid increases according to the current Loan Plus terms and conditions. They are specified in the loan agreement.

How to repay the loan?

You need to repay your Loan Plus loan within the terms specified in the agreement's terms. As a rule, the term is up to 30 days. If the repayment condition has not been fulfilled, the client receives a notice about the accrual of penalties and fines on the entire amount owed.

To avoid problems in making the payment, Loan Plus Sri Lanka offers you to choose one of the repayment methods:

- Online transfer. You can send funds to the company's account from any card. The contract specifies the details of the current account and other necessary information for this purpose. Keep the receipt to confirm the payment.

- Cargill's Food City. You can pay the debt at the branches. For this, prepare the data of the current account and indicate your surname. It is recommended to keep the receipt for confirmation after the transaction.

- Pay&Go. Finding kiosks in any city is easy, so they are popular. Note that the transfer of funds takes some time.

Save your checks and other documents to give them to your manager. This way, you confirm the payment and can avoid unpleasant situations. The term of crediting funds by the loan agreement number depends on the chosen option.

Why are online loan offers favorable?

The Loanplus company offers to receive credit funds in a convenient mode. Registering for the service and choosing the preferred lending terms is enough. Low-interest rates for customers who applied for the first time are not the only advantage of the work.

Processing an application for a loan takes no more than 10 minutes. Managers process customer requests around the clock. In addition, the service is available on weekends and holidays. Also, weekends are not provided in the schedule of loan on Loan Plus.

Transparent loan terms are the next advantage of working with the company. The borrower immediately gets answers to his questions. Information about terms, conditions, and requirements is specified on the website and in the agreement. Careful study of the contract will help to avoid complications.

Those users who have a bad credit history can also take a loan. A high approval rate allows you not to worry about a positive decision. The application is approved in 95% of cases, indicating that it is easy to get a loan quickly.

Credit funds are transferred directly to the client's card. It means the recipient does not need to look for an offline Loan Plus branch in his city. In addition, you can also repay the debt online. To do this, choose convenient online banking, specify the details for payment, and carry out the transaction quickly.