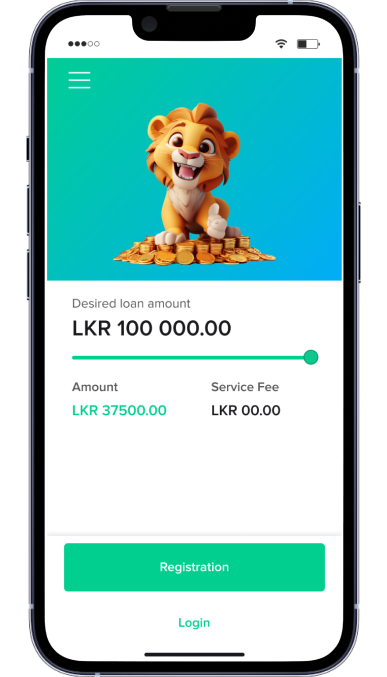

- Payment amount includes principal & service charges

- The approved loan may differ from your request

24/7 - acceptance of applications

Giving everyone up to LKR 100,000 for any purpose

Registration in 10 minutes

Fill out the application form

Complete registration documents as instructed

Wait for review results

Get the results of the review the same day after completing the applicationReceive a loan

Get money into your bank accountWe give the opportunity to prolong the loan period

From: Rs. 5,000

To: Rs. 50,000

Interest rate from 0% to 16%

Example of the first loan: You apply for Rs. 5,000.00 / - and pay in full after 121 days of using the loan. Service fee is 0 / month.

Total amount to be settled Rs. 5,000.00 / -

Example for a Repeat loan: You apply for Rs. 5,000.00 / - and pay in full after 121 days of using the loan. Payment 2867 / month.

Total amount to be settled Rs. 8,600 / -

We created a game so you can take more possibilities to win personal discounts

An online loan is an unsecured credit product that you apply for, sign and receive entirely through the internet; approval is data-driven and funds typically reach your bank account within minutes to 48 hours, making it a fast, paper-free alternative to branch-based borrowing.

Unlike traditional personal loans, an online lending platform automates identity checks, credit scoring and e-signatures. All interactions happen on a website or mobile app, and customer support is handled via chat or email. Because overheads are lower, many fintechs offer competitive fixed interest rates while maintaining instant-approval service levels.

Do you urgently need money, but your bank account, wallet, and stocking hid under the bed are empty? First of all, in such moments, we turn to family and close friends, but they cannot always lend a helping hand. Good way to get the missing money quickly is online loans. Read the article and find out about loans on the Internet: what it is, how to get it, and other interesting facts.

Most often, online loans are offered by lenders of the non-banking sector, but often banks also allow customers to fill out an application, for example, for a consumer loan, in online form. However, in this case, documents need to be drawn up on the spot in any branch of the bank.

Alternative forms of funding, such as microcredit, are now becoming a useful tool for operational support for small and medium-sized enterprises. In addition, they provide opportunities for individuals without access to traditional forms of credit (bank lending). Online credits, according to current data in the country, refer to cash loans online up to Rs 50,000, with a base interest rate.

For Sri Lanka, unlike other Asian countries, the lenders are banking institutions (a huge share of which belongs to cooperative banks). The introduction of a special institutional framework by the Ministry of Economy and Development is in the final stages of preparation and envisages the establishment of a Microcredit Fund to be capitalized by specialized companies (microcredit providers) supervised by the Bank of Sri Lanka. At this stage, these organizations are limited to simple mediation services (advice, information, collection of supporting documents, etc.).

According to statistics, the main reason why people apply for personal loans is to cover daily expenses. According to the OnCredit study, about a third of applicants (34%) for quick credit cites household expenses as a reason to borrow. In Sri Lanka, as in the rest of the world, the quick-credit or cash lending service of lending companies has proliferated. There are even online comparison services for various loan, mini-credit, and cash lending companies where you can select a lender using filters and feedback. Many people simply overwhelm, thus consolidating debt, this is the second most frequent cause of rapid borrowing (23 %), followed by others (16 %), moving (9.1 %), and medical (7.8 %).

The benefits and disadvantages of microcredit are the same in each case. Advantages of this tool:

Using micro-loans, IFIs clients may:

The weaknesses of this tool include:

Before taking out a mobile online loan, you need to assess the pros and cons of the product, weigh all the factors to make microcredit effective. If offers from IFIs did not benefit users, they would not be in high demand in the consumer market.

Convenience is good, but consumers need to know what they get. It is recommended to ask the following questions before signing the agreement:

What is the product and what are the conditions?

Online lending is gaining ground in Sri Lanka. In situations where the money is needed here and now, this is one of the best ways to solve the problem with maximum speed and maximum self-benefit using OnCredit loan calculator. With the help of access to the worldwide network, the necessary amount can be obtained from anywhere in the country.

Even though the reasons differ from one country to another, mainly people choose to obtain credit on the Internet for three purposes, namely:

But if you’re thinking about getting credit on the Internet, the most important thing is to assess the situation. OnCredit’s convenient lender calls: Before using a bank or non-bank lenders, assess the possibility to repay the loan within the agreed term using OnCredit loan calculator.

Since microcredit is granted for a short period, it is generally assumed that the interest rate is higher than for a cash lending bank. But this is not always the case in practice.

Some organizations bet high percentages on their offers. But it’s not all IFIs, and it’s not all IFIs. Some organizations generally lend to their new customers at 0-0.2%, which is much more profitable than cash lending at the bank.

The main risk of microcredit is precisely high-interest rates. But if you choose the loan wisely and compare the offers from various institutions on our site OnCredit, you can avoid overpayment and process the loan not only quickly but profitably.

Microcredit is low-interest loans of 30,000 rupees up to 50,000 rupees, the address of which existing micro-enterprises and the unemployed, who want to realize their business - an idea. They are usually issued by banks without collateral and guarantees are provided by specialized government bodies. Microcredit is accompanied by business development services (training, mentoring, coaching, consulting, accounting, and legal support) to ensure continuous and close communication between the lender and the borrower. The amount of credit can be used for both working capital and investment costs.

OnCredit offers attractive microloans for your personal needs (holidays, travel, daily needs). OnCredit, the most reliable alternative source for individuals and companies, offers EVERYONE -40%, CODE: YT2CF, as well as a comprehensive and flexible personalised lending scheme that provides solutions to meet your own and/or emerging needs of your family.

In other words, you can now easily and simply obtain loans and cash through time-consuming and painstaking procedures.

Why should you issue an online loan through the Internet?

To collect the money for any purpose, and it has been credited to a bank account, it is necessary only to fill in the online loan application in OnCredit.

After a company checks your online loan application (up to 15 minutes) and you pass the approval, you will be able to borrow money online for any needs: money before salary, credit for repairs, credit for the purchase of equipment, credit for education, or consumer credit for any personal needs.

There are almost no restrictions on borrowing money. To obtain a credit card, the borrower must be a Sri Lankan citizen, have a national identification card, , and an active bank account. They may be students, pensioners, unemployed persons, persons without formal employment or income certificate, without guarantors, or with a relatively poor credit history.

IFIs loan terms: loans (credits) are usually granted for up to 30 days, interest is charged daily and the amount of the first loan is up to 3.5 (sometimes 5) thousand rupees.

In simple and flexible ways, OnCredit offers attractive microloans, which you can use for holidays, wedding expenses, for your home and emerging needs, as well as for other daily contingencies.

Online loans are great for covering urgent and emergency situations. It is important that you understand the responsibility of using the funds. Tips to keep in mind:

Use these tips to safely cover any emergencies that arise.

| New loan | Repeat loan |

| Term: 5 day | Term: 10-30 day |

| Amount: 2K-50K | Amount: 20K-100K |

| Interest rate: 0% | Interest rate: 1,73% |