24/7 - acceptance of applications

Quck loans online

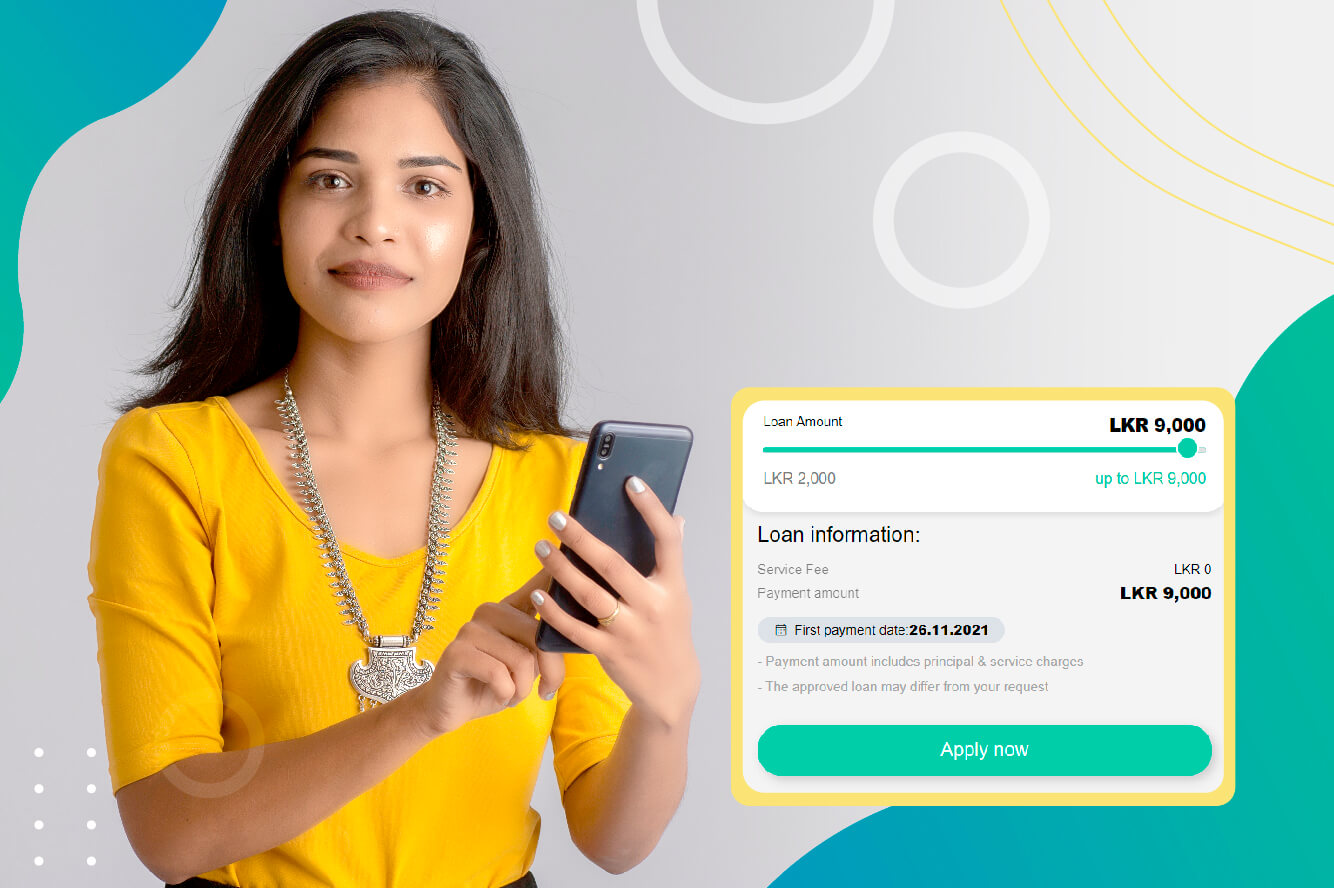

Repeat loan with profit! Use promo code LK126 and get a -35% discount on your next loan. Apply now and save money with us!

The act of borrowing money is one which most of us are reluctant to engage in but the current circumstances caused by the disastrous state of the global economy has left us with no other choice. The rising piles of bills and personal debt combined with reduced incomes and increased cost of living not only leaves us needing to borrow money from somewhere, but needing to do it fast. If you have ever found yourself in a situation where you needed quick cash, having access to a quick loan service is indeed a great blessing and all too often, a rare one to find. A cursory scan of available quick cash loan options heralds countless service providers and money lending facilities - so many that it seems impossible to pick one or even know where to start from!

Let’s take a look at everything you need to know when you find yourself needing quick online loans in Sri Lanka

Where can I get quick cash loans from?

In the past, the words “quick” and “loan” were considered an impossible combination, with borrowing money being a very formal service offered exclusively by either large banks and monetary institutions or unsavoury loan sharks. However, economics have changed to such an extent that even the world’s richest people willingly go into debt to fund ventures and large transactions. Due to this, ordinary people like us have a plethora of options to choose from.

Here are some quick loan options and their pros and cons.

|

Option |

Pros |

Cons |

Ideal for... |

|

Borrowing from friends and family |

|

|

Borrowing from friends and family should be your absolute last resort when you have run out of all options, and should only be for small- to medium-sized loan values. Try to arrange for a written agreement with witnesses to formalise the affair and reduce misunderstandings. |

|

Banks |

|

|

Borrowing money from the bank is suitable for larger amounts of money for pre-planned transactions such as major purchases or large-scale debt settlement e.g. credit card full settlement |

|

Credit Cards |

|

|

Credit cards are useful if used smartly. Take advantage of credit card offers to get deals on essential purchases and utilise interest-free instalments to cover crucial large purchases. Avoid falling into the credit card debt trap by settling your bill in full each month without fail. |

|

Overdrafts |

|

|

Ideal when making official payments or withdrawing cash in an emergency as it is basically like taking an advance from your savings or an expected payment. |

|

Loan Sharks |

|

|

Loan sharks are the only option for people who have terrible credit histories and need money urgently. The general rule of thumb is to avoid loan sharks like the plague. |

Apart from all the above options, the advent of technology and the widespread demand for quick cash loans with minimal documentation and proof of assets required have birthed a totally new type of quick loan service in recent times - Quick Online Cash Loans.

What are quick online cash loans?

Quick online cash loans are basically money-lending services offered by private non-banking entities through a virtual platform, like a website or mobile app. These quick loan services have skyrocketed in popularity as of late by taking the word “quick” to greater heights than ever before: you can apply for a quick cash loan and have the money in your bank account in as less as sixty minutes.

Benefits of Online Quick Loans in Sri Lanka

There are many benefits of online quick loans, when compared to the above-mentioned options,

Fast

The entire process from application to receiving the money can be done in around an hour or even less if you meet all the prerequisites. With just a few taps and clicks, you can complete your transaction.

Easy

The signing up and application process is so easy that it can be completed very easily by even a first-time borrower or a completely tech unsavvy person without needing to contact customer support.

Reliable

Unless you have a very bad credit history with bankruptcies and multiple non-payments of debt in the past, it is very unlikely that your application for a quick cash loan will be rejected. This makes it a very reliable credit facility.

Convenient

As these online quick cash loans take place on a virtual or digital platform which requires minimal human interaction, the entire transaction can be completed from your own home, without needing to leave your seat. You can even apply for a loan at midnight.

Private

As you are dealing with a completely external third party money lender, your privacy is guaranteed; your loved ones and social circle will never know that you needed to borrow money.

How do quick cash online loans work?

While it all seems to be too good to be true, online quick loan providers are able to offer this service by utilising what is known as an unsecured loan. Unsecured loans do not require the borrower to offer any proof of assets or a guarantor to vouch for him; they simply look at the borrower’s past credit history to adjudge whether he can be trusted to lend money to. Therefore, in these types of quick cash loans, the majority of the risk is undertaken by the lender. The trade-off for this is that the borrower might not get approved for a very large loan on his first try (but can do so as their relationship with the lender grows through consecutive borrowings and successful repayments) as well as extremely high interest rates and fees.

Sri Lanka quick loans companies

Consumer loan companies in Sri Lanka

- Age, employment - 20 to 60 years old, currently employed, or have a steady income

- Sum and terms - 5-30 day Rs.2000-100000

- Fees rates - 0-12%

- Telephone availability - Yes

- Photo Verification - Yes

- Special proposition - Yes

- Age, employment - 20-60 years old, have a steady income

- Sum and terms - 3-6 month, Rs. 5000-80000

- Fees rates - 23%

- Telephone availability - Yes

- Photo Verification - Yes

- Special proposition - Yes

- Age, employment - 20-60 years old, have a steady income

- Sum and terms - 3-6 month, Rs. 5000-50000

- Fees rates - 15.8 to 18.1% per month (maximum APR 216.12%)

- Telephone availability - Yes

- Photo Verification - Yes

- Special proposition - Yes

- Age, employment - 20-80 years old, have a steady income

- Sum and terms - 3-6 month, Rs. 10000-50000

- Fees rates - 30% per month

- Telephone availability - Yes

- Photo Verification - Yes

- Special proposition - Yes

- Age, employment - 22-55 years old, have a steady income

- Sum and terms - 3-6 month, Rs. 5000-40000

- Fees rates - ⁓15%

- Telephone availability - Yes

- Photo Verification - Yes

- Special proposition - Yes

- Age, employment - 22-55 years old, have a steady income

- Sum and terms - 3-6 month, Rs. 15000-40000

- Fees rates - 0,3% per day

- Telephone availability - Yes

- Photo Verification - Yes

- Special proposition - Yes

- Age, employment - 20-60 years old, have a steady income

- Sum and terms - 3-6 month, Rs. 5000-50000

- Fees rates - 0,4% per day

- Telephone availability - Yes

- Photo Verification - Yes

- Special proposition - Yes

How can I get a quick cash loan online?

The speed and ease of online quick cash loans can be seen in the entire process, as seen below.

- Selecting a good service provider:

Possibly the most crucial step, determining the trustworthiness of a money lender can be done by looking at customer reviews and checking how transparent they are in their dealings. You want to avoid any online quick loan provider that does not detail their terms and conditions openly. For example, OnCredit.lk not only prompts its customers to read the terms and conditions at multiple stages of the application process but also offers these in multiple languages. - Applying for the loan:

Most of the time, these quick loan service providers require just a photo of yourself and your national identity card to attach to your loan application which will contain your personal details, contact details, required loan value and duration, as well your bank account number into which the loan will be deposited. This entire process will take place on a website or a mobile app. - Verification phone call:

Once you have completed your application, you will receive a phone call from a loan officer to verify the authenticity and accuracy of the details provided by you. - Loan approval / rejection:

Once the verification call has concluded satisfactorily, the loan officer will check your credit history. Barring any major red flags (like past bankruptcies or loan defaults), you will likely be approved for the loan - albeit at a possibly lower value than you requested - and you will get a SMS or an e-mail notifying you that your loan request was approved or rejected. If approved, you will get the quick cash loan deposited to your bank account almost instantaneously.

The next time you find yourself needing a quick cash loan, you have no need to worry as you have so many options to choose from. Just a few years ago, getting a quick loan online in Sri Lanka might have been considered an impossible feat. But technological innovation and business-minded entrepreneurs came together to provide a service that is much appreciated by thousands of people around the country and which is helping their lives every single day.