Cryptocurrency has become one of the new trends across all facets of the finance and technology industries. Everyone from finance and tech gurus to celebrities are investing in cryptocurrencies and touting them as the next best thing and the future of finance. However, many people still don’t fully understand the nature of cryptocurrency as the reality is that the cryptocurrency ecosystem is still being developed.

Let’s take a closer look at cryptocurrency and its potential uses in the finance industry.

What is Cryptocurrency?

Simply put, cryptocurrency is virtual money (or digital cash) that is not backed by any organisation, tangible assets or securities. It is created, exchanged and regulated by its user base, and its value depends on the amount of people who wish to buy it. Cryptocurrency utilises a type of cryptography known as blockchain that allows secure, direct unbrokered transactions between parties. Cryptocurrency only exists in a digital format and is currently not yet recognised by many parties as being a legitimate form of currency, but that point of view is changing rapidly.

How does it work?

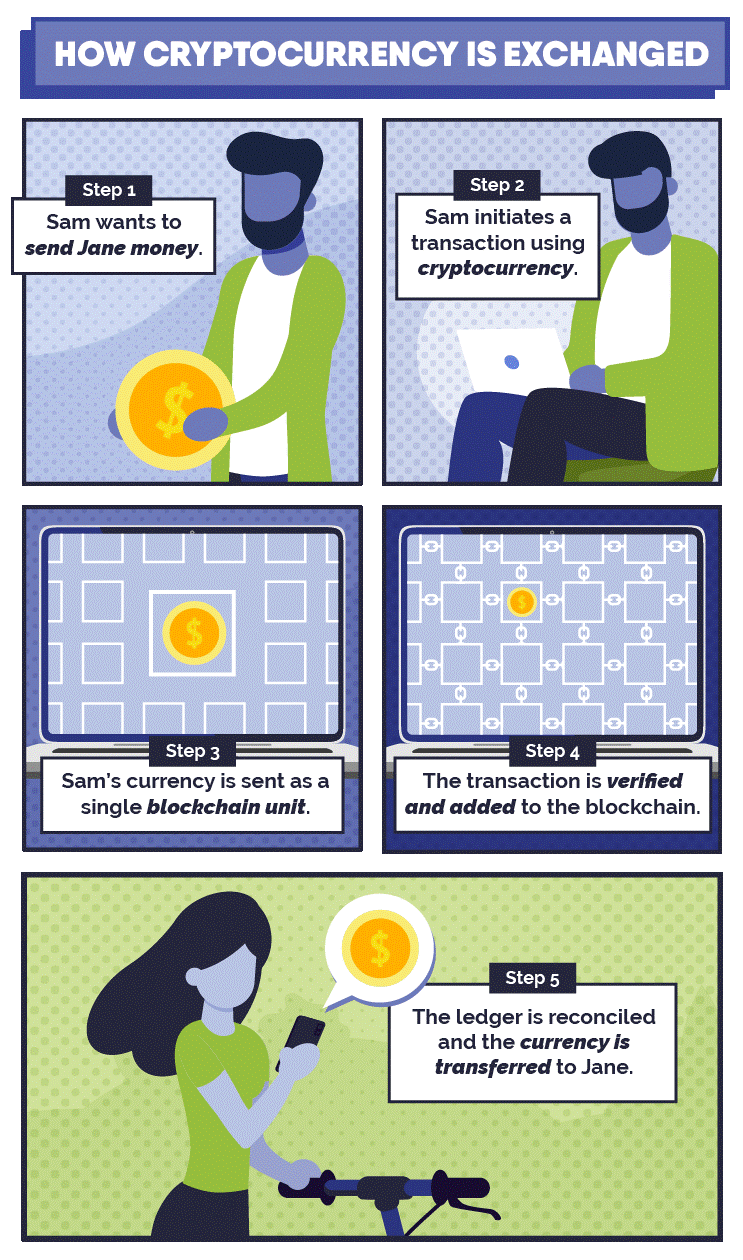

Cryptocurrency requires owning a digital wallet which can store and facilitate transactions. Cryptocurrencies are purchased on online exchanges such as Coinbase. The following diagram explains what exactly happens during a transaction with cryptocurrency:

History of Cryptocurrency

While the concept of cryptocurrency has been around for decades, its popularity skyrocketed during the last few years. This was when Bitcoin emerged on the market following the financial crisis of 2008. It was created by an anonymous developer known as “Satoshi Nakamoto” whose identity remains secret to this date. Bitcoin is currently the most popular form of cryptocurrency and 1 bitcoin (BTC) is currently valued at close to USD 40,000. Ethereum is another very popular cryptocurrency. Several companies now allow payments in Bitcoin, and both Visa and Mastercard support cryptocurrency transactions.

Benefits of Cryptocurrency

- Cryptocurrency is finite and only a limited number of coins of each type exist, therefore it is protected against price instability and fluctuations the same way that other commodities (like gold etc.) are.

- Cryptocurrencies are decentralised which means the politics and economic situations of a particular country or region do not affect its value. This makes cryptocurrency a very stable way of keeping money.

- As it’s still the early days of cryptocurrency, investing now has the potential to grow your investment with time. When cryptocurrency becomes widely accepted as a payment method, the value of the coins you own will see extreme growth

Drawbacks of Cryptocurrency

- One of the biggest concerns associated with cryptocurrency is that it's trustless. Bitcoin’s origins are entirely unknown along with the identity of its creator, and cryptocurrency in general is not backed by any country, government or organisation. While some people argue that this level of decentralisation is a key benefit of cryptocurrency, it is undeniable that it also carries some risk.

- As cryptocurrency is in its infancy stage, there are still little to no regulations applied on cryptocurrency purchase and transactions. The very nature of cryptocurrency is to eliminate any party apart from the sender and receiver which means it’s not conducive for regulation as well.

- Unless you are somewhat tech-savvy, it might be difficult to determine the authenticity and legitimacy of certain aspects of cryptocurrency. There have been instances in the past where people have been scammed, and even some fraudulent Initial Coin Offerings (ICOs), where people were tricked into investing in fake cryptocurrencies.

- Forgetting your password to your digital wallet means that there is no way for you to access your cryptocurrency. The entire log-in process has been made in a way that it firmly prevents those who do not have the password from accessing your coins.

The Future of Cryptocurrency

.jpg)

The future of cryptocurrency is still very unclear. Critics doubt it will ever become a norm in the finance industry, while proponents are convinced it will disrupt the global finance ecosystem. However, cryptocurrency is likely to force change in various industries and how people view transactions.

Cryptocurrency has great potential to disrupt the entire future of finance with the concept of decentralised finance becoming popular. People are already increasingly disillusioned with the current finance ecosystem which is non-transparent and somewhat inaccessible for certain people, especially when it comes to investing, trading, borrowing, and lending.

The reality is that there are many instances where cryptocurrency is an ideal solution as it addresses many limitations of physical currencies. In its current state, however, cryptocurrency still has a long way to go before it replaces physical currencies in day to day transactions. (Read here - Will Digital Currencies Replace Bank Accounts) With technological advancements and more widespread acceptability from users and merchants, as well as greater transparency in its operations, cryptocurrency is well on its way to becoming a staple of modern society.